Your Business Growth with Flexible Business Loan Solutions

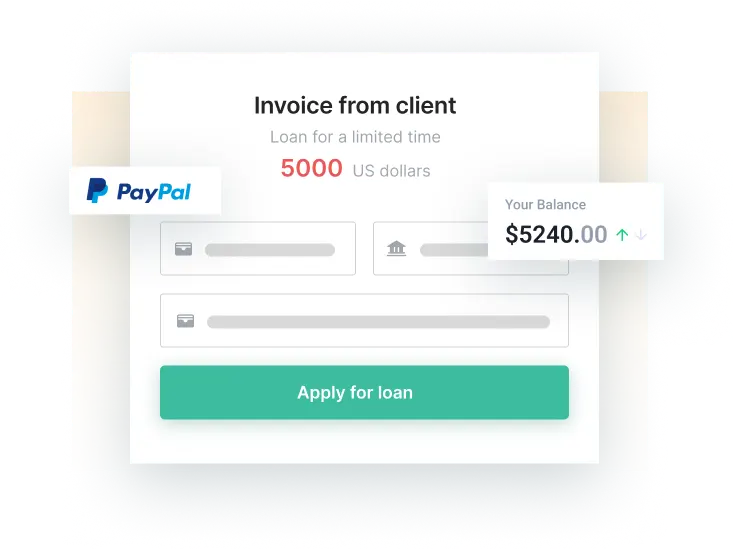

Provide required documents like financial statements, tax returns, and business plans.

Features and Benefits of our Business Loan

⦿ Team Loan

⦿ Working Capital Loans

⦿ Business Expansion Loans

⦿ Equipments Financing Loans

⦿ Invoice Financing & bill Discounting

⦿ Machinery Loans

Business Loan Eligibility Criteria

⦿ Business Types: Most lenders provide loans for all kinds of businesses, from sole proprietorships and partnerships to limited liability companies (LLCs) and corporations.

⦿ Credit Score: To qualify for a business loan, lenders will usually require that your credit history is strong and they use this to assess whether you can repay the loan in time.

⦿ Business Age: To meet lender criteria, some banks require at least six to 12 months of operational history for your business.

⦿ Annual Revenue Requirement: Lenders may impose minimum annual revenue requirements to ensure your business can rely on steady earnings.

⦿ Secured loans often require collateral in the form of real estate, equipment, inventory or other valuable assets to guarantee repayment.

⦿ Cash Flow: Lenders will often examine your business’s cash flow to evaluate your ability to repay a loan.

⦿ Age Criteria: For loan application and maturity. A borrower must be 21 or over to apply and 65 or above when repaying.

⦿ Eligible Entities: Individuals, micro and small enterprises (MSMEs), sole proprietorships, partnership firms, public and private limited companies (PLC), limited liability partnerships (LLP) retailers traders manufacturers and other nonfarm income-generating business entities engaged exclusively in services trading and manufacturing sectors are eligible entities.

⦿ Business Vintage: Products 1 year or older.

⦿ Experience: Minimum one year; location must remain the same.

⦿ Annual Turnover: Defined by Bank/NBFC

⦿ Credit Score: of 700 or above (Preferred by most private and public banks).

⦿ Nationality: Citizens of India

⦿ Additional criteria: Applicants must own either a residence, office, shop or Godown as part of their criteria for eligibility.

Documents required to apply for Business Loan

The list of documents required for a business loan to be submitted varies based on type of business entity. Submit the following documents to begin with the loan process:

⦿ ITR for the past 2-3 years

⦿ Current Bank Account Statement for the last 12 months

⦿ Photocopy of PAN Card

⦿ Address Proof for Residence such as Voter Card, Passport, Aadhaar Card, Telephone Bill, Electricity Bill

⦿ Address proof for Business such as the Telephone Bill or Electricity Bill

⦿ Last Financial Year’s provisional Financials and future year’s projections.

⦿ Company’s business profile on the letterhead

⦿ 2 photographs of promoters and property owners.

⦿ Sanction letter and Repayment schedule of existing loan

⦿ GST registration certificate and GST returns of latest 2 years.

⦿ D-Vat/Sale tax registration copy

⦿ Udhayam Aadhaar registration certificate

⦿ Rent agreement copy of factory and residence (if property is rented)

⦿ Business Continuity proof of 3 years (3 years old ITR/Company registration etc)

⦿ Company PAN Card, Certificate of Incorporation, MOA, AOA, List of Directors, and Shareholding pattern for Pvt Ltd companies

⦿ Partnership Deed, Company pan Card for Partnership Companies

EMI CALCULATOR

Monthly EMI: ₹0

Total Payable: ₹0

Total Interest: ₹0

Monthly EMI Breakdown (From Current Month):

| Month | Principal Paid | Interest Paid | Balance |

|---|

Personal Loan Reviews

I was looking for a business loan to expand my operations, and CredMart made it a smooth process. The approval was fast, and the team guided me every step of the way. I got the funds I needed without any hassle. Highly recommend

Quick Approval and Great Support

Ravi Kapoor, EntrepreneurGetting a business loan can be overwhelming, but CredMart simplified everything. From quick eligibility checks to personalized loan offers, they made sure I received the best terms. A reliable platform for all your business financing needs.

Hassle-Free and Reliable Business Loan

Aarti Gupta, Small Business OwnerI was impressed by how transparent and efficient the entire process was. The CredMart team helped me get the best loan offer for my business with clear terms. The funds were disbursed quickly, and the customer service was exceptional.

Transparent and Efficient Process

Manoj Verma, Startup FounderYou helped me secure the funding I needed to take my business to the next level. The loan process was simple, and the team was extremely helpful. I could easily compare different offers and choose the best one for my needs.

Perfect Solution for Growing Businesses

Sandeep Mishra, Business OwnerFAQs

What is a business loan, and how much can one borrow?

Depending on several factors, including the loan amount, loan term, income, and employment history, different lenders have different minimum credit score requirements to be approved for personal loans. Most lenders consider a credit score of 650 or above to be strong enough to qualify for a personal loan. To be eligible for a personal loan with low-interest rates and advantageous terms, some lenders may require a credit score of 700 or better.

Who can apply for a business loan?

Business loans are made available to various entities, such as sole proprietorships, partnerships, LLCs, corporations, non-profit organizations and startups. Eligibility criteria typically depend on factors like creditworthiness, revenue growth and profitability of the business as well as an applicant's personal credit history - each lender may have specific criteria so it is advisable to contact them for specific requirements.

What are requirements to get a business loan?

To obtain a business loan, typically all that's necessary is providing a business plan and showing proof of good personal and business credit scores; filing financial statements and tax returns; offering collateral as security if needed; legal documentation such as bank statements and personal identification may also be needed; so be sure to speak with potential lenders regarding the requirements specific to their loan applications.

What is Udyam?

Udyam Registration or MSME Registration is a special card granted to small and medium-sized enterprises by the government of India that grants them special recognition as micro, small, or medium enterprises (MSMEs). This registration card features its own unique number as well as certification that confirms they are MSMEs - helping these small businesses secure loans with lower interest rates, reduced collateral requirements and faster processing times so that they may thrive more easily over time.

By registering under Udyam, businesses can also take advantage of government subsidies, tax benefits and financial support tailored specifically for them. This initiative forms part of India's ongoing effort to encourage entrepreneurialism and support MSMEs' growth.

What is the minimum CIBIL Score required for a business loan?

Minimum Cibil scores required for business loans typically range between 650+ and depend upon different lenders.

How can I qualify my business for an instant business loan?

To qualify for an instant business loan, you typically need a good credit score, stable revenue, and a low debt-to-income ratio. Lenders may also require your business to have been operational for a certain period. Meeting these criteria increases your chances of qualifying for an instant business loan, which can provide quick access to funds for your business needs.

What security is required to avail the business loan?

Business loans are unsecured loans in which one does not require collateral to secure financing from any lender.

How do I qualify for a business loan?

Assuring eligibility for a business loan typically involves meeting criteria like having good personal and business credit scores, meeting minimum levels of revenue, time in business and lender requirements such as financial statements and business plans. Meeting these requirements increases your odds of qualifying; however requirements may differ among lenders.

Can I pay off a business loan early?

Yes, early repayment of business loans can generally be completed, though it's essential to review your loan agreement to ascertain any prepayment penalties or fees that might be applicable. Some lenders charge fees if early repayment occurs before its agreed-upon term has passed; other lenders allow early payment without incurring penalties. If you plan to make early payments of your business loan early, contact your lender first in order to understand any possible fees and discuss options available to you.

Access to secure banking

Lorem Ipsum is simply dummy text of the printing and the typesetting industry. Lorem Ipsum has been industry's

Get started now

Bank account replacement

Lorem Ipsum is simply dummy text of the printing and the typesetting industry. Lorem Ipsum has been industry's

Get started now

Treasury management online

Lorem Ipsum is simply dummy text of the printing and the typesetting industry. Lorem Ipsum has been industry's

Get started now

Best accounting software for micro businesses

Lorem Ipsum is simply dummy text of the printing and the typesetting industry. Lorem Ipsum has been industry's

Get started now