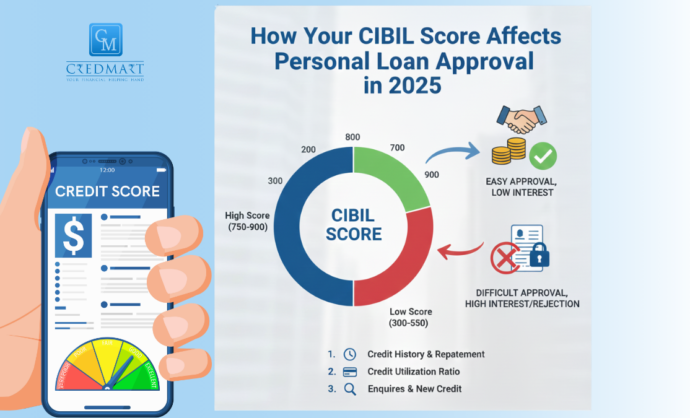

How Your CIBIL Score Affects Personal Loan Approval in 2025

In 2025, personal loan approvals are faster than ever. However, one thing still matters the most: your CIBIL score. As a result, many loan applications get rejected simply because applicants don’t understand how their credit score works.

A CIBIL score ranges from 300 to 900 and reflects how well you manage credit. It is based on your repayment history, credit card usage, existing loans, and credit applications.

The higher your score, the better your chances of loan approval.

Why CIBIL score is crucial in 2025

Most banks and NBFCs now use automated systems for loan approvals.In fact, your CIBIL score is often checked first, even before income details.

A good score means:

- Faster approval

- Better interest rates

- Higher loan eligibility

A low score can lead to rejection or costly loan terms.

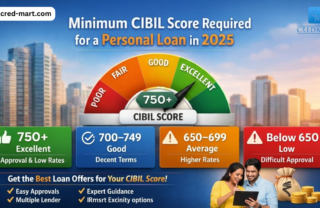

CIBIL score range and approval chances

- 750 and above: High approval chances, best interest rates

- 700–749: Good chances, standard rates

- 650–699: Approval possible with higher rates

- Below 650: High risk, limited options

Can you get a personal loan with a low score?

As a result, options are limited and interest rates are usually higher. Proper guidance helps you avoid repeated rejections.

Platforms like CredMart guide karte hain, connecting you with suitable lenders based on your credit profile.

How to improve your CIBIL score

- Pay EMIs and credit card bills on time

- Keep credit card usage below 30 percent

- Avoid applying for multiple loans together

- Check your credit report regularly

Final note

In 2025, your CIBIL score is your financial reputation. Knowing your score before applying for a personal loan can save time, money, and stress.

Minimum CIBIL Score Required for a Personal L

When applying for a personal loan in 2025, your CIBIL s...

Recent Posts

- RBI Home Loan Guidelines in India: What Every Homebuyer Should Know

- Best Loan Services in Noida – A Complete Guide to Choosing the Right Lender

- Fixed vs Floating Home Loan | Which is Good Interest Rate?

- How to Increase Your Chances of Home Loan Approval

- What Is a Prepayment or Foreclosure in a Personal Loan?