Credit Card EMI vs Personal Loan EMI – Which is Cheaper?

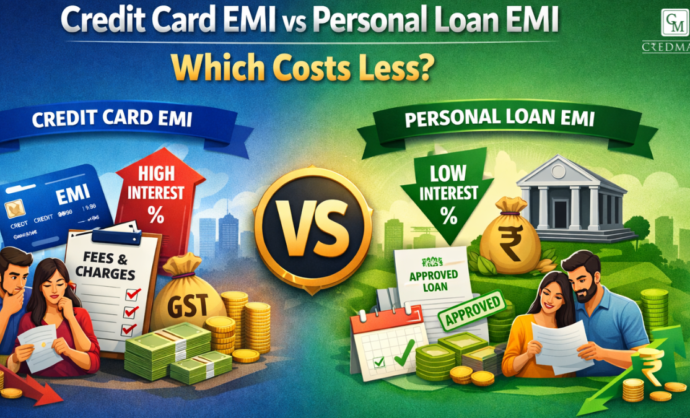

When you need quick money for a big purchase or an unexpected expense, the choice often comes down to Credit Card EMI vs Personal Loan EMI.

At first glance, both options seem similar. You borrow money and repay it in monthly instalments, but the total cost can be very different

Understanding Credit Card EMI

Credit Card EMI also allows you to convert your credit card dues or expenses into easy monthly instalments. It’s everywhere because it’s fast and easy.

What makes people go for Credit Card EMI?

-

No paperwork in most cases

-

Instant approval if you’ve already got a card

-

Useful for small, urgent purchases

But here’s the catch

-

Interest rates are usually higher

-

Processing fees are common

-

Interest and fees attract GST

-

Your credit limit is blocked for the EMI amount

And while the EMI looks manageable, the total outgo over time could be quite high.

Understanding Personal Loan EMI

It is a type of unsecured loan, which means you are given the money without any security from the bank or NBFC and you have to pay it back in fixed EMIs (Equated Monthly Installment) over a period.

Why people prefer personal loans

-

Interest rates lower than those of credit cards

-

Fixed repayment schedule

-

Your credit card limit remains unaffected

-

Better for larger expenses

Things to keep in mind

-

Requires basic documentation

-

It might be a while before approval arrives

-

APR based on credit score and income

For planned expenses or larger sums, personal loans generally make more financial sense.

Interest Rates: The Biggest Difference

That is where the bulk of the cost delta is realized.

EMI interest charges on a Credit Card are much higher, typically in the high teens and upwards to over 30% per annum.

The interest for Personal Loan is lower as compared to Gold Loan and that also when you have good credit score.

Small percentage differences can add up to thousands in total repayment over time.

Hidden fees you should look out for

People consider comparing EMIs just by monthly amount, which is wrong.

Credit Card EMI may include:

-

Processing fees

-

Foreclosure or cancellation charges

-

GST on interest and fees

Personal Loan may include:

-

Processing fee (usually one-time)

-

Some situations with prepayment or foreclosure penalties

Most of the time, personal loans are more upfront about their total cost.

Impact on Your Credit Score

You can check how different loans affect your credit score on the official CIBIL website.

Your credit score will be affected by both of these options, but in two different ways.

Credit Card EMIs block the available credit limit, thereby adding to your credit utilisation. High utilization is bad for your score.

Personal loans are distinct from other types of credit. You can even use them to build credit if you pay on time.

If you are already a heavy user of your credit card, opting for a personal loan might be the safer bet.

Which Option Is Cheaper Overall?

A personal loan is cheaper than a credit card EMI in most cases, especially when:

-

The loan amount is high

-

The repayment period is longer

-

You have a good credit score

Credit Card EMI can still make sense for:

-

Small purchases

-

Very short repayment periods

-

When you require money fast

But for practically anything else, personal loans tend to win on price.

A Simple Example

Think about borrowing equal amounts from either.

Though the monthly installment looks ‘affordable’ through Credit Card EMI, the interests and charges add up to expand the final cost.

Under a Personal Loan, the EMI can be the same or even lower and the total repayment is typically less.

That is why you should not just concentrate on the EMI, but also calculate the entire amount that you will be paying.

Overall, when comparing Credit Card EMI vs Personal Loan EMI, personal loans usually turn out to be the cheaper option for most borrowers.

Final Verdict

If you pick on the basis of cost alone, personal loan EMI is generally cheaper. There is convenience in Credit Card EMI, but it frequently comes at an expensive price.

Before deciding, always compare:

-

Interest rate

-

Total repayment amount

-

Fees and charges

-

Impact on your credit profile

Comparing just for a few minutes could save you thousands of dollars down the road.

New GST Updates for Loan Services – What Yo

India’s indirect tax system is undergoing a major tra...

How to Increase Your Chances of Home Loan App

Getting a home loan approved can be challenging, but fo...

Recent Posts

- RBI Home Loan Guidelines in India: What Every Homebuyer Should Know

- Best Loan Services in Noida – A Complete Guide to Choosing the Right Lender

- Fixed vs Floating Home Loan | Which is Good Interest Rate?

- How to Increase Your Chances of Home Loan Approval

- What Is a Prepayment or Foreclosure in a Personal Loan?