Minimum CIBIL Score Required for a Personal Loan in 2025

When applying for a personal loan in 2025, your CIBIL score remains one of the most important factors lenders consider. It helps banks and NBFCs assess your creditworthiness and decide on loan approval, interest rate, and loan amount.

At CredMart, we guide borrowers at every credit stage to find the most suitable loan options.

What Is a CIBIL Score?

A CIBIL score is a three-digit number ranging from 300 to 900 that represents your credit behavior. It is calculated based on:

Repayment history

Active loans and credit cards

Credit usage

Credit age

Loan application frequency

A higher score reflects responsible credit management and increases lender confidence.

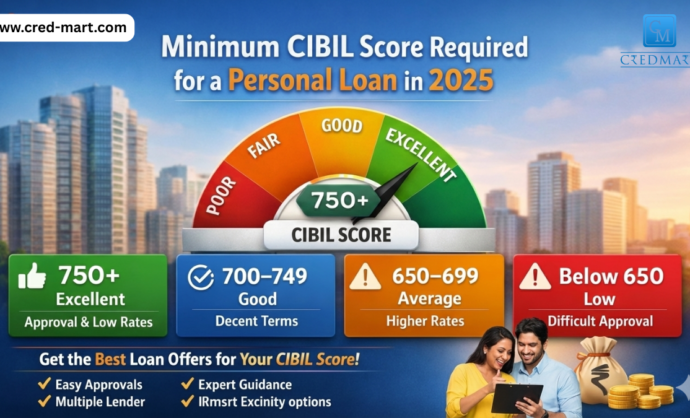

Minimum CIBIL Score for Personal Loan Approval in 2025

While exact criteria vary by lender, most follow these general ranges:

750 and Above – Excellent

High approval probability

Lower interest rates

Faster disbursal

Higher loan eligibility

This is the preferred score range for top banks and financial institutions.

700 to 749 – Good

Good chances of approval

Competitive interest rates

Accepted by most banks and NBFCs

650 to 699 – Average

Approval possible with select lenders

Interest rates may be higher

Income and employment stability matter more

Below 650 – Challenging

Limited approval options

Higher interest rates

May require a co-applicant or strong income proof

No CIBIL Score? First-Time Borrowers in 2025

If you do not have a CIBIL score, you are not automatically disqualified. In 2025, lenders assess first-time borrowers based on income consistency, job profile, and banking history.

With proper guidance, even applicants without a credit history can secure a personal loan.

Other Factors Lenders Consider

Apart from your CIBIL score, lenders also evaluate:

Monthly income

Existing EMIs

Employment or business stability

Age and location

Overall financial profile

At CredMart, we match your profile with lenders that best suit your eligibility.

How to Improve Your CIBIL Score

If your score is low, these steps can help:

Pay EMIs and credit card bills on time

Keep credit usage below 30 percent

Avoid frequent loan applications

Clear overdue accounts

Monitor your credit report regularly

Even small improvements can significantly impact loan approval and interest rates.

Why Choose CredMart?

CredMart works with multiple banks and NBFCs to help you:

Get personal loans with competitive interest rates

Find options even with low or average CIBIL scores

Receive expert guidance at every step

Experience faster processing and transparent support

Apply for a Personal Loan with CredMart

Not sure if your CIBIL score is good enough? Let CredMart guide you to the right lender based on your profile.

👉 Check your eligibility today

👉 Apply for a personal loan with expert support

👉 Get the best possible offer for your CIBIL score

Contact CredMart now and take the next step toward smart borrowing.

How Your CIBIL Score Affects Personal Loan Ap

In 2025, personal loan approvals are faster than ever. ...

Recent Posts

- RBI Home Loan Guidelines in India: What Every Homebuyer Should Know

- Best Loan Services in Noida – A Complete Guide to Choosing the Right Lender

- Fixed vs Floating Home Loan | Which is Good Interest Rate?

- How to Increase Your Chances of Home Loan Approval

- What Is a Prepayment or Foreclosure in a Personal Loan?