Personal Loan vs Salary Overdraft Loan: Which Is Better for You?

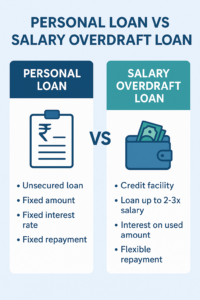

When faced with urgent financial needs, many individuals compare two popular borrowing options: the Personal Loan and the Salary Overdraft Loan. Both are designed to provide liquidity, but they work in very different ways. At Credmart, we believe that understanding these differences is key to making the right financial decision.

In this detailed guide, we will explain the features, benefits, and limitations of each, helping you determine whether a Personal Loan or a Salary Overdraft Loan is better suited to your needs.

What Is a Personal Loan?

A Personal Loan is an unsecured borrowing option offered by banks and financial institutions. It does not require collateral and can be used for almost any purpose—whether it is for medical bills, weddings, education expenses, travel, or debt consolidation.

-

The loan amount typically ranges from ₹50,000 to ₹25 Lakhs, depending on your income and credit score.

-

Repayment tenure generally varies between one to five years.

-

Interest rates are usually fixed and can range from 10% to 24% annually.

-

The repayment happens through fixed monthly EMIs.

-

Disbursal is quick, often within 24–48 hours for salaried individuals.

Advantages of Personal Loans

-

No collateral required.

-

Large loan amounts are available.

-

Structured EMI repayment brings predictability.

-

Funds can be used for any purpose.

Disadvantages of Personal Loans

-

-

Higher interest rates compared to secured loans.

-

Repayment begins immediately, whether or not you need funds at that time.

-

Prepayment or foreclosure charges may apply.

-

What Is a Salary Overdraft Loan?

A Salary Overdraft Loan (SOD) is a credit facility linked directly to your salary account. It allows you to withdraw more than the balance available in your account, up to a pre-approved limit. This limit is usually two to three times your monthly salary.

-

There is no fixed disbursal like in personal loans. Instead, you withdraw as needed.

-

The facility is ongoing and is usually reviewed by the bank annually.

-

Interest is charged only on the amount withdrawn and for the duration it is used.

-

Repayment happens automatically when your salary is credited each month.

-

It is available only if your salary account is maintained with the lending bank.

Advantages of Salary Overdraft Loans

-

Interest applies only on the funds you actually use.

-

Instant access to money without repeated paperwork.

-

No burden of fixed EMIs.

-

Best for short-term or unexpected financial needs.

Disadvantages of Salary Overdraft Loans

-

-

Limited loan amount compared to personal loans.

-

Only available if salary is routed through the bank.

-

If you change jobs or close the salary account, the facility may end.

-

Not suitable for large expenses like weddings or home renovations.

-

Key Differences Explained

The primary difference between a Personal Loan and a Salary Overdraft Loan lies in the way they are structured. A personal loan provides a fixed lump sum that you must repay through monthly EMIs, irrespective of whether you need the full amount at once. On the other hand, a salary overdraft functions more like a credit line—you only pay interest on what you withdraw, making it more flexible for smaller, short-term needs.

While personal loans can fund large expenses over a long tenure, overdraft loans are designed for those who need liquidity on demand.

When to Choose a Personal Loan

You should opt for a Personal Loan if:

-

You need a large amount of money for a big event or purchase.

-

You prefer predictable, structured repayments through EMIs.

-

You are planning long-term expenses such as education, medical treatment, or weddings.

-

You have a strong credit score and can qualify for better interest rates.

When to Choose a Salary Overdraft Loan

A Salary Overdraft Loan is the right choice if:

-

You face frequent short-term financial gaps.

-

You want flexibility, where interest applies only when you actually withdraw funds.

-

You need instant money without going through a fresh loan application.

-

You do not want the pressure of monthly EMIs.

Which Saves You More Money?

For large planned expenses, a personal loan is more suitable because it provides a lump sum with a structured repayment schedule. However, if your needs are small, recurring, or unpredictable, a salary overdraft loan can save you more money because you pay interest only on the exact amount you use, and only for the time you use it.

Example: If you take a personal loan of ₹3 Lakhs at 14% for 3 years, you will pay EMIs every month on the full loan amount. In contrast, with a salary overdraft limit of ₹3 Lakhs, if you withdraw only ₹50,000 for two months, you will pay interest solely on that ₹50,000 for those two months—not on the entire ₹3 Lakhs.

Final Verdict: Personal Loan vs Salary Overdraft Loan

Both options have clear benefits, but the right choice depends on your financial situation. If you require a large, one-time amount with long-term repayment, a Personal Loan is the better solution. If you want short-term liquidity with minimal interest costs, a Salary Overdraft Loan is more practical.

At Credmart, our advice is to analyze your financial goals, repayment ability, and urgency before making a decision. Remember, the best borrowing option is the one that aligns with your needs and gives you maximum flexibility without straining your budget.

Lowest Personal Loan Interest Rates in 2025 �

One of the most common ways to deal with pressing finan...

New GST Updates for Loan Services – What Yo

India’s indirect tax system is undergoing a major tra...

Recent Posts

- RBI Home Loan Guidelines in India: What Every Homebuyer Should Know

- Best Loan Services in Noida – A Complete Guide to Choosing the Right Lender

- Fixed vs Floating Home Loan | Which is Good Interest Rate?

- How to Increase Your Chances of Home Loan Approval

- What Is a Prepayment or Foreclosure in a Personal Loan?